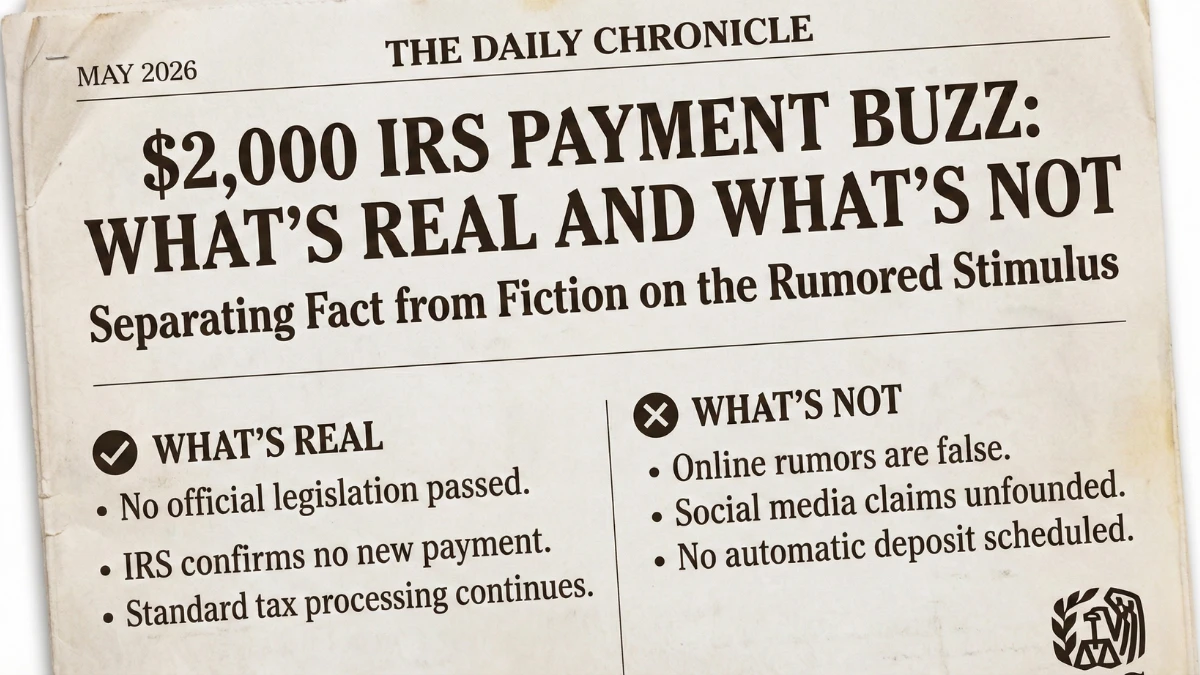

Online discussions about a $2,000 IRS payment arriving in May 2026 have increased, causing confusion among taxpayers across the United States. To stay accurate and compliant with misinformation guidelines, it’s important to clarify that the Internal Revenue Service cannot issue nationwide payments unless a specific law authorizes them. This article explains the full process, what the $2,000 talk actually refers to, and how taxpayers should understand May 2026 payment claims.

Is a $2,000 IRS Payment Approved for May 2026

No. There is no officially approved $2,000 IRS payment scheduled for May 2026. No legislation, Treasury directive, or IRS notice confirms such a payment. Without Congressional approval and formal guidance, the IRS cannot issue a universal deposit.

Why the “$2,000 in May 2026” Claim Is Circulating

Most of these claims come from misunderstanding regular tax refunds, refundable credits, or average refund estimates. Some taxpayers may receive refunds around $2,000 in May due to individual return processing timelines, but this is not a special IRS payment program.

How IRS Payments Actually Work (Official Process)

| Stage | What Happens |

|---|---|

| Tax return filed | IRS receives your return |

| Return accepted | Initial checks completed |

| Processing | Income and credit verification |

| Refund approved | Refund amount finalized |

| Payment sent | Direct deposit or check issued |

There is no separate process for a universal $2,000 payment.

Who Could Receive Around $2,000 in May 2026

A taxpayer may receive a refund near $2,000 only if their personal tax calculation results in that amount. This depends on income, withholding, credits, and deductions—not on a fixed IRS payout.

Eligibility Reality

There are no eligibility rules for a May 2026 $2,000 payment because no program exists. Eligibility applies only to approved programs such as tax refunds, which require a filed and accepted return.

How to Check Your Legitimate IRS Payment Status

Taxpayers should use official IRS refund-tracking tools after filing their return. These tools show real-time status for approved refunds only, not rumored or unapproved payments.

What Taxpayers Should Avoid

There is no signup, activation, or fee required to receive IRS payments. Messages claiming to confirm or release a $2,000 payment should be treated with caution.

ONE Bullet-Point Section (KEY FACTS)

- NO $2,000 IRS payment is approved for May 2026

- IRS payments require Congressional authorization

- Refund amounts vary by individual

- No special eligibility list exists

- Only official IRS notices are valid

Conclusion

The $2,000 IRS payment talk for May 2026 is not based on any approved federal program. Any money received in May would be a regular tax refund, calculated individually. Taxpayers should rely only on official IRS tools and announcements for accurate information.

Disclaimer

This article is for informational purposes only and does not constitute tax, legal, or financial advice. IRS payments and refund timelines depend on individual filings and official government procedures.

He specializes in simplifying complex government policies into easy-to-understand guides for everyday Americans. His work focuses on IRS refund schedules, Social Security payment dates, benefit eligibility rules, COLA updates, and federal tax changes.